Over the last decade, certainly up to the 2008 market crash, one of the hottest-selling investment products was the variable annuity. While there is no silver bullet out there, variable annuities (VAs) were often presented as an investment tool that came with guarantees of income for the investor. After getting burned by the market in early 2000s, many investors were looking for just that: A guarantee.

After all, that is what an insurance company is for; they transfer the risk to another person. In this situation, investors transferred their risk of loss of retirement income to the insurance company.

Here’s how the story went: The client comes into the office and explains they just lost 20% or more in the stock market (think 2000, 2001 and 2002, when the DOW was down 10%+ each of those three years) and are looking for something a little more conservative. The advisor introduces them to a VA. It is fairly straightforward: You invest your money with an insurance company and place the investment into the VA’s subaccounts, which look, smell and act a lot like a mutual fund (many are actually named and run by some of the largest mutual fund companies out there). When the market goes up, you go up; when the market goes down, you go down. Nothing really new there, except, and it was a big except, the VA would also guarantee that your investment would grow at a specified rate of return. Pretty attractive, right? How did that work?

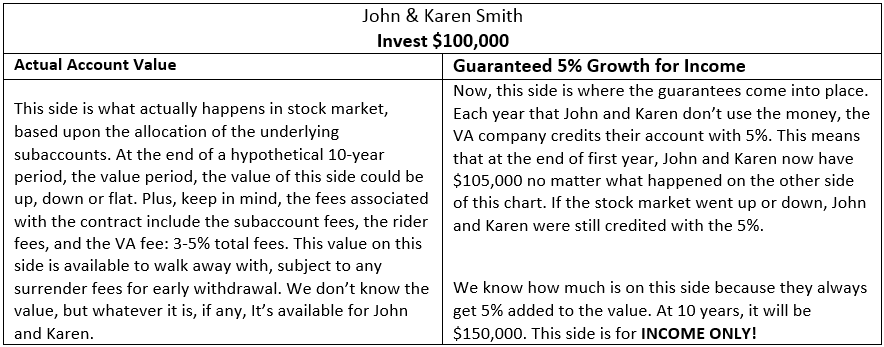

Let’s take a look at an example:

John and Karen invest $100,000 with X, a variable annuity company. They allocate their $100,000 among a choice of subaccounts – large cap growth, small cap growth, a couple bond funds, an international fund, etc. At the same time they make this investment, the VA company sets up a “second account,” or a guaranteed account. This account is going to grow at 5%. At the end of 10 years (nothing special about the 10 years, just an easy number for math), the guaranteed account value is $150,000. That’s right, it is guaranteed to be worth $150,000 (we didn’t account for compounding, for simplicity’s sake).

What about the actual account that John and Karen allocated among a bunch of subaccounts? At the end of 10 years, it is up, down or maybe even flat. I don’t know. It pretty much followed the market up, down and all around. This is exactly why John and Karen wanted that guarantee in the first place. They wanted their account to grow no matter what happened.

So, what’s the catch? This sounds like a great idea, right? If the stock market goes up, John and Karen make money. If the stock market goes down, John and Karen are guaranteed 5%. Why wouldn’t everybody do this?

Here’s the catch: The 5% that was guaranteed can only be used for income. That is correct; John and Karen can’t walk away with that money. They can take an income stream for a period of years, possibly for their entire lives. That’s great if John and Karen invested with the idea that they wanted to secure an income stream, and with today’s current economic volatility, it might make sense to have another source of guaranteed income (along with Social Security and, if you are one of the lucky retirees, a pension).

Of course, there are other strings attached. Variable annuities were much maligned and, quite frankly, are still looked down upon by many advisors and journalists. They all voice concerns about high fees (they can be quite high, some average 3.5-5%) as well as surrender fees and lack of liquidity (surrender fees can range from 1-2% all the way up to 10-15%, possibly even more). And, of course, the guarantee is only as good as the insurance company itself; after all, they are the ones making the guarantee.

And therein lies the rub: They made a guarantee and now they aren’t so sure it was a good idea. Sounded good at the beginning: Collect a lot of fees, make a guarantee they hope they never have to pay out on, and did I mention collect a lot of fees? Keep in mind that the stock market “averages 8-10% over time.” They certainly kept that in mind and assumed they would never really have to pay out that guarantee. Why? It was assumed that John and Karen’s actual return, even after fees, would be greater than the 5% the insurance company guaranteed.

Unfortunately for investors and the insurance company, the market hasn’t averaged 8-10% over the last decade, and that has left a lot of insurance companies on the hook for some pretty significant guarantees. Being on the hook for a large sum of money is no way to make a profit, and now many insurance companies are looking to unload their obligations.

Insurance companies are now offering to buy you out of your contract by offering you about 80% of what the current guarantee happens to be. For example, using John and Karen’s guarantee of $150,000 (to be used for income), an insurance company may offer them $120,000 to give up their policy and let the insurance company off the hook for the future payments that would be owed to John and Karen.

Before you jump at the offer, you should consider the reason for making the purchase in the first place. Hopefully, if you purchased an annuity with a guarantee, you purchased it for that guarantee. If so, then giving up the reason for the purchase in the first place might not make sense. Don’t get caught up in the ability to walk away with a lump sum. Remember, you purchased this vehicle for the purpose of producing income. For John and Karen to produce the same $7,500 yearly income (most VA guarantees require you to withdraw a percentage of the guaranteed income amount in order to access the money. Here we used a 5% withdrawal rate: $150,000 x 5% = $7,500), they would have to secure a yearly return of 6.25%, which is not as easy to do in today’s economic environment. Remember, the 6.25% would have to be guaranteed because the $7,500 was guaranteed. That isn’t easy in today’s interest rate environment.

So before you agree to a buyout offer, sit down and evaluate your specific situation and, based upon all the facts, make a determination on what is in your best interest.

If you own a variable annuity with a guaranteed withdrawal benefit or income benefit, we encourage you to call Prostatis Financial Advisors Group, LLC so we can review how your specific guarantee works, what fees you are paying, whether you are eligible to cash out your guarantee, and if there is a better solution to your retirement income needs.

Call our office at (410) 863-1040 today for a free, no-obligation analysis to see if you can safely and securely increase your retirement income.

About the Author:

As founding member of Prostatis Financial Advisors Group, LLC, Michael Canet has built his business and reputation on the stability he provides for his clients. His retirement and estate planning carefully allocates his clients’ assets so they can retire with the confidence, income and tax-deferred wealth protection they need to create the quality of life they deserve.

Michael regularly appears as a leading financial professional in Forbes, USA Today, and the Wall Street Journal, as well as on ABC, NBC, CBS, and Fox affiliates around the country. He is the best-selling author of Surviving the Perfect Storm.

Michael is a devoted husband and father. In his free time, he enjoys camping, playing catch with his boys, and spending quality time with his family.

P.S. – Don’t forget to share this blog using the social media icons if you found it useful! Thank you!

Your feedback will be delivered to the author, so be sure to let us know your thoughts using the Comments section below.